This post was originally published in [2021] and has been fully updated for 2026 with new data and tools.

Investors often ask, “Why is YFI price so high but market cap low?” while comparing it to “cheap” coins like Dogecoin.

The answer lies in extreme scarcity. While Bitcoin has 21 million units, Yearn Finance is capped at a tiny 36,666 tokens. This creates a high unit price even when the total valuation (market cap) is relatively small.

The Yearn Finance Token has a high price because there are only 36,666 tokens. You can also use the token for staking and to vote on upcoming ideas.

Keep reading, and I’ll share what Yearn Finance does, why the token is worth so much if it is undervalued, why the iron bank is unique, and the project I’m “most” bullish on.

YFI Value Calculator

Calculate your Yearn Finance holdings instantly.

Data synced with CoinGecko API.

Yearn Finance Max Supply: 36,666 YFI.

Yearn Finance Tokenomics: Why YFI Price Hits $3,000+ While Supply Stays at 36,666

YFI is the native token on this blockchain, and some people call it Y-Foo.

The token has 0 pre-mine (it's where they give a lot before launch). The reason this is good is that it makes it fair for everyone.

This 0 pre-mine is as rare as a "baby hippo in a tutu" (I got this saying from an old sales gig I did). The token was initially given as a reward for people who used the platform.

ONLY 36,666 YFI tokens were created, and they have all been given out already.

There are 2 uses for this token.

- Staking

- Vote on stuff

If you're not sure what staking is, you can check out this post I made on how it works. In a nutshell, you earn money from your money. (cool right?)

Also, the YFI token runs on the Ethereum blockchain and is an ERC20 token. You can think of an ERC20 token like WordPress for a website (it just makes it easy to build on).

It also just makes it easier for wallets and exchanges to accept the token (to keep things simple). ERC means Ethereum Request for Comment, and 20 is just a random number.

In case you're a nerd (like me), 50% of all the tokens on the Ethereum blockchain are ERC20 tokens according to this source.

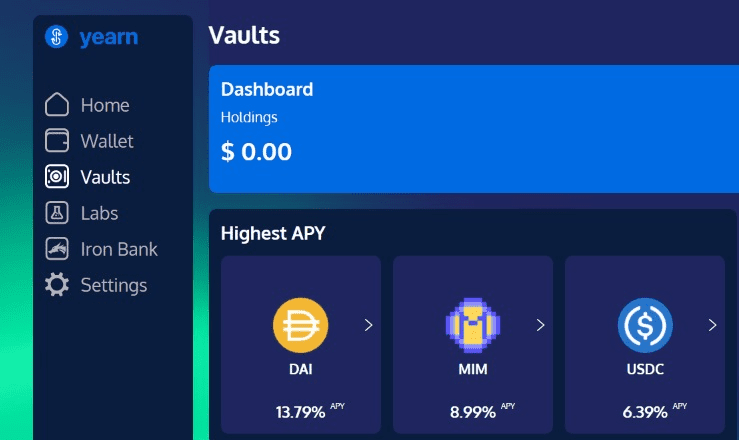

Is Yearn Finance Still Relevant in 2026? A Deep Dive into yVaults v3 and Automated Yield?

Back in 2021, someone had to manually move their money to get a better yield.

In 2026, with automated yield, as you can guess, this process has been automated (yay).

yVaults have also been updated!

Back in 2021, it was more complex, higher fees, with a Max 20 strategies per vault. The updated v3 in 2026 is simpler, fewer fees and unlimited strategies per vault.

Yearn Finance is a DeFi (decentralized finance) project that is built on Ethereum. It was created by Andre Cronje, who some people feel created DEFI.

He built an automated system for yield farming for himself.

Later, he thought others could use this system, and I-earn was born and later changed its name to Yearn.Finance. In case you're wondering what Yearn means, it's a longing for something, typically what was lost or separated from.

The fact is EVERY DeFi project is built on Ethereum, apart from 1 that I know of.

Yearn Finance is a dapp (decentralized application) that supplies money to various pools on Ethereum.

These pools can be Aave, which I wrote a post about HERE, Compound, and DYDX. These pools have rewards that fluctuate, and the Yearn dapp tries to find the highest rewards for your money.

You could think of it like a little employee that works for you.

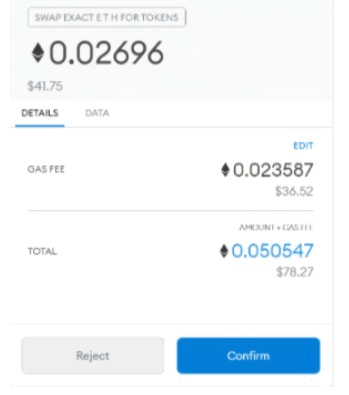

When it comes to Ethereum, what does everyone hate the most? Yes, gas prices.

The reason you would want to use Yearn is that it can save money on the (dreaded) gas fees.

You could think of instead of getting into your car and driving 100 miles, you would carpool with 4 people, and all split the gas.

Another service Year Finance offers s you can loan tokens and earn interest, and this is the "iron bank". Reminds me of the series Game of Thrones, right?

What is "very" interesting is that they are offering zero collateral loans through a partnership with "Cream". How they are doing this is through a credit system. It does seem they are very strict on who gets a loan.

You can read the full article on how this works HERE. How do you feel about this?

Seems very risky. I would be too nervous borrowing money and lending money.

Honestly, I'm NOT a fan of leveraged investing in crypto. Part of the reason for the depression in the U.S. was "many" people buying stocks on margin (borrowing money).

Crypto is risky enough as it is; add borrowed money, and I'm not sure if that is brave or stupid.

Brave if you earn money and stupid if you lose money, right?

YFI Value Analysis 2026: Comparing Yearn Finance Revenue vs. Market Cap Metrics

Yearn Finance can be undervalued if you're bullish on DeFi and Ethereum.

Every project has pros and cons, just like this one. Yearn Finance had a very interesting launch due to the creator NOT keeping any coins.

This is a good thing. The project also serves a need, which is reducing gas prices for Ethereum with liquidity mining.

Liquidity mining is "great" because you can earn money from your money (who doesn't like that?). There is also a very low supply, and there is a demand for the product.

Low supply and high demand mean the price probably will go up, but anything can happen.

What I don't like about Yearn Finance is that it's completely dependent on Ethereum. Ethereum is going through a lot of changes now and is Turing-complete.

Turing complete means it can do "everything," but there is more of a chance of something going wrong. If there is a bug in the smart contract, then "anything" can happen.

In fact, in February, there was a mistake in which 11 million dollars were lost, and you can read about it HERE. Oops, the reason there is Ethereum Classic and normal Ethereum is due to a mistake in the code.

A second thing is that the UI (User Interface) looks old-fashioned and is NOT very user-friendly (this is just my opinion).

People are lazy, so the easier it is for someone to use the product, the better! It's also difficult to find tutorials on how to use the system.

When it comes to liquidity mining, there is a risk of "impermanent loss." This is when the value of 1 coin goes down, and you withdraw your deposit.

The truth is, this impermanent loss can happen if you just hold any token (or investment), so it's the same risk with anything.

Conclusion to Why is YFI price so high but market cap low?

I'm bullish on YFI because I feel DeFi and smart contracts will grow, but anything can happen. My favorite DeFi project is based on Bitcoin because it's more stable and simple.

Oh, and there are NO gas fees!

They are also doing some cool stuff with tokenizing stocks and assets. They have a massive German community, and I know the founders. You can learn more about this DeFi project by clicking on this link HERE.

Sadly, many governments are printing money at alarming rates, leading to inflation. Crypto is one tool we can all use to keep ahead of it.

Whatever crypto project you're into, it's a good idea to have your money work for you.

Also, crypto is risky.

We live in some crazy times, and it's not a good idea to just count on 1 income source, like the government, crypto, or a job, because things change.

One way to diversify is with a side hustle.

Affiliate marketing is not a bad idea because you can do it anywhere, anytime, around your schedule, with very little start-up cost, in nearly any niche, and it can be a lot of fun.

I've been doing it for 15 years, and I'm giving away my system for FREE HERE.

I hope this post on Yearn Finance was helpful to you. Bye for now.