Uniswap is one of the leading decentralized exchanges or DEX for short. The bad news is sometimes the fees can be high and you may be wondering why. You also might be curious about what someone can do to reduce these fees.

- You can reduce fees on Uniswap by exchanging Weth (wrapped Ethereum) for a token.

- You can also reduce fees by seeing what other DEX’s charge and picking the one with the lowest fees.

- There is a way to reduce fees by making some changes on Metamask!

Keep reading and I’ll share what’s so special about Uniswap and what the token does. I’ll also share a few other DEX’s you can use to reduce your fees.

How to Reduce Fees?

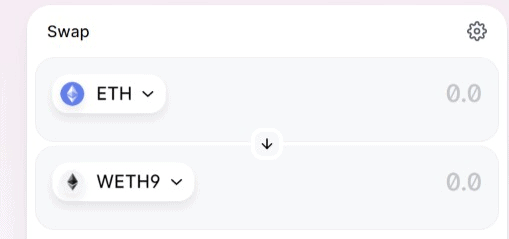

The first way to reduce fees is by converting Ethereum to wrapped Ethereum called Weth first. It will look something like…

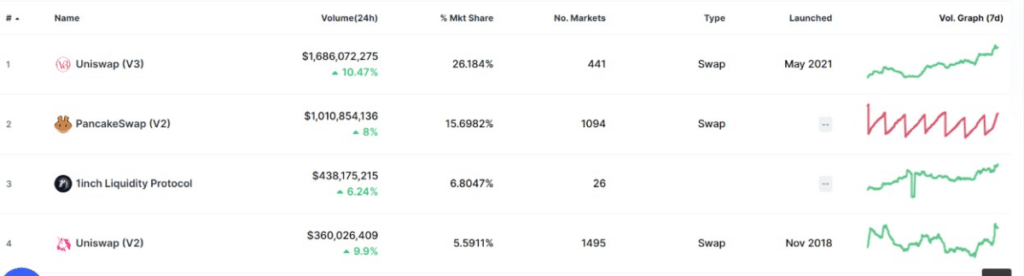

The second way is to shop around for a better exchange.

One exchange is Polygon that uses a Layer 2 solution called “Matic.” You could think of a layer 2 solution is instead of having TONS of tiny transactions there is 1 large transaction that has many tiny ones in it.

This could save you money in gas fees. Oh, and you would be using a service called Quickswap, which is similar to Uniswap. You can learn more about Quickswap by clicking on the link HERE.

There are other exchanges as well. The one I really like is “Defi Chain” which is unique because it’s based on Bitcoin.

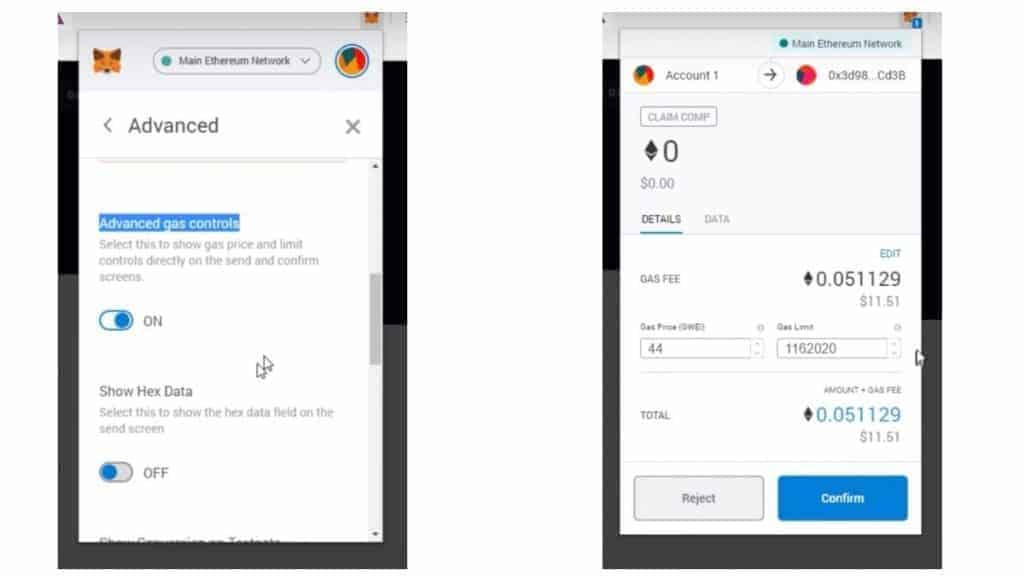

The last item is to tweak Metamask to save money on gas fees.

One way to reduce gas fees “on Metamask” is to click on the round icon on the top right and click on Settings. Next, scroll down to Advanced and turn on Advanced gas controls.

This enables you to save more money on gas fees. It works well with the website ethgasstation.info. Now when you send something you can type in the gas prices that would see on Ethereum gas station.

Another idea is to wait and see if the prices drop. Maybe in the middle of the night gas prices will be less money.

Here is a post on how you can save more money using Metamask by clicking on the link HERE.

What is SO Special About Uniswap?

Uniswap is decentralized and this has some advantages to normal exchange. One advantage is your helping the little guy, which are small people trying to earn money with their crypto.

There is no KYC verification for the exchange and no central exchange rules.

Uniswap is the biggest DEX and started in 2018 with no ICO “initial coin offering.”

Someone can connect to Uniswap with Metamask. You do remain in control of your coins the entire time, unlike an exchange.

Apart from being an exchange Uniswap has a feature that allows you to pay someone in a token you don’t hold.

Uniswap just launched V3 on July 13, 2021. The problem is the update did little to address the HIGH gas prices on the Ethereum network. The fees you will pay are usually $30 and sometimes MUCH higher for gas on each Uniswap trade.

Oh, and there are other fees such as liquidity provider fees (it’s 0.30%) Liquidity provider fees are there to incentivize people to provide liquidity to the exchange, otherwise, why would they do it?

There is also something called slippage. Slippage is the real-time price when you make a trade that is different than the market price. The bigger the amount you trade the higher the slippage can be.

Lastly, is the price impact and this is the difference between the market price and the estimated price.

Price impact and slippage sound similar, but they are a little different.

Lastly, apart from making trades on the platform, you can actually earn money by providing liquidity. In return for adding liquidity “the same amount of tokens on each pair” you would get some high returns.

The risks are the same as if you purchased the tokens and the price dropped a lot.

The truth is investing in ANY crypto is risky!

The problem with Uniswap is the high fees to move Ethereum. This is why I’m a fan of using Defi Chain because there are MUCH lower fees.

What is the Uniswap Token?

If Uniswap allows someone to swap Ethereum for another token, what is the point of the Uniswap token?

The Uniswap token is a governance token. By having a governance token someone can vote on ideas that control the Uniswap exchange?

Some of these ideas could be how new tokens are distributed to people. Maybe there is a proposal to the fee structure and by holding the Uniswap token you can vote on it.

The real reason the token was created was to incentivize people to NOT go to sushi swap another DEX that was forked from Uniswap.

Sushi swap wanted to reward people with Sushi tokens to move to the platform and Uniswap wanted to reward people with its tokens to stay.

There are 520 million of these tokens in circulation and a supply limit of 1 billion will be created.

Other DEX’s?

Uniswap isn’t the only decentralized exchange and there are “many” others. One DEX, that I have to mention is Defi Chain.

What makes DEFI unique is that it’s not based on Ethereum, which nearly ALL DEX’s are.

DEFI chain is based on Bitcoin and it’s Non-Turing complete, which is a fancy way of saying its more simple with fewer things that can go wrong.

Oh, and the gas fees are going to be MUCH less because it’s not Ethereum.

I know the creators of Defi chain, they have BIG plans for the future of the project and a large community. The best part is you can earn some “killer” rewards for being a part of the project.

You can learn more about Defi Chain by clicking on the link HERE. You can use the code 939517 for $30 in free coins if you make a deposit of over $50. Cake runs on DefiChain and is the best way to start.

Apart from Defi Chain, there are many other exchanges. I recommend looking at 2 or 3 choices and going with the exchange that saves you the most money.

I hope this blog post on why Uniswap is so expensive and 3 ways to reduce fees was helpful. Bye for now.