The Binance Coin or BNB has some interesting ideas, one of them is the coin burn. Yes, they are using cash to buy their coins and destroy them forever.

Binance is burning their coins to reduce the supply and increase the price of it. Every 3 months Binance will use its profits to buy 20% of their supply and destroy them.

Keep reading and I’ll share some effects of the coin burn and how often it’s going to happen. I’ll also share what utility or value the Binance Coin has that affects the price.

Impact of Binance Coin Burn

Every 3 months Binance plans on using its profits from the exchange to buy 20% of the supply of BNB coins and destroying them.

Binance will continue to do this until it has destroyed 50% of the total supply. The total supply of BNB coins is 200 million and thus they plan on destroying 100 million.

If you compare this to Bitcoins 21 million Binance still has “a lot” of coins in circulation.

Why would Binance destroy its own coins? It comes down to supply and demand. If there is a reduced supply of something then it increases the price of it.

There still has to be a demand for it, even if the supply is reduced.

The reason diamonds are valuable is that there is a limited amount of them. If diamonds fell from the sky every day then they wouldn’t be as valuable.

I used to sell cars at a Honda dealership and I remember Honda only made so many S2000, so this forced dealerships to only accept a high price. If one S2000 came to the dealership and 10 people wanted it then it would drive up the price.

The problem with the BNB coin is there are still 100 million coins out there after burning 100 million, (this is a lot). Still, it’s a marketing tactic and it seems to be working since Binance is the 4th MOST popular crypto according to CoinMarketCap at the time of this blog post.

The next question is how valuable is the BNB coin? Why do people want this thing?

What is the BNB Coin?

The BNB coin or Binance coin was created to run on Ethereum in 2017. Then in 2019, it launched its own blockchain called the Binance Chain or BC.

The Binance Chain or BC offers fast trading and transfers. The BNB coin is also used to reduce fees on the Binance exchange by 25%.

The BNB coin can’t be mined. All 200 million coins were pre-mined during Binance’s initial offering. Instead, someone can get a positive return through staking and thus supporting the network.

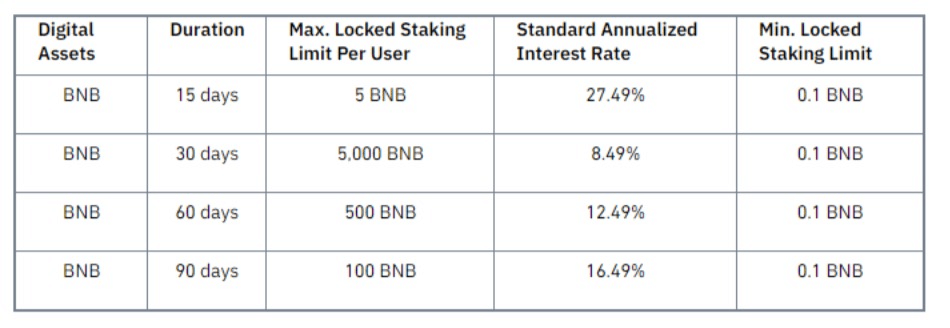

Someone can earn 8.49% to 27.49% APY when they stake their BNB coins. The catch to receive the 8.49% APY is you have to lock your money up for at least 30 days.

To receive 27.49% APY you have to lock your money for longer.

Remember APY is the Annual Percentage Yield and the returns you would get if you locked your money away for a year.

If you take your money out after 30 days then the APY rate would be divided by 12. There is also the minimum and maximum amount you can stake.

To get the 27.49% APY you can only stake 5 BNB. It’s good to read the fine print right?

Next, up the BNB coin can be used as a currency with select merchants. The problem is the list of merchants that accept the BNB coin is low – but hey it’s marketing and sounds good right?

Here is a list of merchants that do accept the coin. Do you see “any” on the list that you recognize?

https://cryptwerk.com/pay-with/bnb/

To be fair more merchants in the future may accept the coin. Also, it’s not like many merchants accept Bitcoin either.

There is “some” value with the Binance blockchain, especially with reducing fees for the exchange, but there is more.

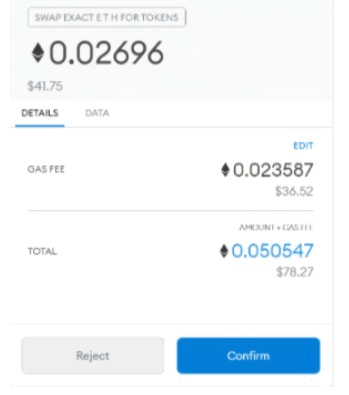

Binance wanted to directly compete with Ethereum itself. Ethereum is a wonderful idea, but it has some problems. The major problem with Ethereum is gas fees and long transaction times.

Gas prices can be insane!

In September of 2020, Binance launched the Binance Smart Chain or BSC.

The Binance smart chain uses Dapps similar to Ethereum, but the fees can be MUCH lower. Plus, they can be faster and this is an advantage Binance has.

The Binance coin or BNB can be used on BOTH blockchains that Binance offers!

Both chains run independently of each other, but both can use the Binance coin. You might be wondering what Daaps or applications are already on the Binance smart chain?

Pancake swap, burger swap, and bagel swap are all on the Binance smart chain. Makes me hungry right?

ALL these swaps are decentralized exchanges. This means someone can exchange one token for another and whoever provides the liquidity can get profits.

Here is another Defi project I’m “very” bullish on called Defichain that I wrote a blog post on that you can read HERE. Defi chain also has coin burns and a “very” high APY.

Future of Binance Coin

I see a bright future for the Binance coin, but Ethereum has a head start. I’m not sure if Binance will pass it up.

The key to crypto is how “many” people support a blockchain the better it’s going to do.

Plus, many sidechains are being developed on Ethereum to reduce fees and speed up transactions.

Still, Binance has cash flow and this “helps a lot.” Plus they have some killer ideas that will help. Binance has purchased CoinMarketCap and Swipe.

CoinCarketCap is the world’s most-referenced price-tracking website for crypto assets. You can view CoinMarketCap by clicking on the link HERE.

Swipe is both a software and digital wallet that helps people spend cryptocurrency and paper money at physical and digital locations.

More good news is Asia’s premier high-end live video platform called Uplive will take the Binance coin as a currency. You can read more about this partnership by clicking on the link HERE. In conclusion, Binance is a major player in the crypto world and its BNB coin has a bright future.

I hope this blog post on why Binance burned its own coins was helpful to you. Bye for now.