This post was originally published in [2022] and has been fully updated for 2026 with new data and tools.

With so many “Ethereum killers” failing to scale, investors are looking closer at the top contenders.

But what is the near protocol coin exactly, and why are there suddenly so many red flags being raised?

While its sharding technology is revolutionary, the project faces stiff competition and centralisation critiques.

The NEAR token is used to pay for transaction fees, to pay for collateral for storing data on the blockchain, rewards for stakeholders, and for governance, so holders can vote on proposals.

Keep reading, and I’ll share what the hell this project is about, what makes it special (AKA different), 5 concerns with this project, and if it’s deflationary.

NEAR Protocol ROI Predictor

Calculate your potential gains for 2026.

What is NEAR Protocol? The 2026 Guide to Sharding and “Chain Abstraction”

The NEAR Protocol is a blockchain that runs smart contracts on it such as Ethereum. There are MANY of these projects out there trying to kill the top dog Ethereum, such as Solana that I wrote about HERE, Polkadot HERE, Cardano HERE, and SO many others.

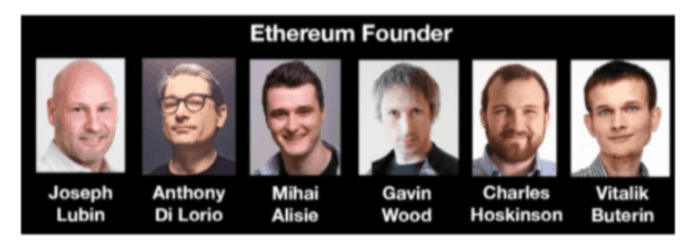

Funny enough, many of the top leaders in these projects were friends. I guess the saying “Too many chiefs, not enough Indians” rang true here.

Gavin Wood founded Palkadot, and Charles Hoskinson started Cardano (which sounds like a mafia family). Of Course, Vitalik Buterin is the founder of Ethereum and is the youngest crypto billionaire at 27 years of age.

The NEAR Protocol does have a few unique cool bells and whistles. One of the unique things about it is something called sharding.

You could think of sharding as eating a pizza with 8 slices. Instead of you eating the pizza by yourself, you got 7 of your friends to help. By having your friends each eat a slice, you would be done MUCH quicker, right?

Sharding works the same way by splitting the work between different validator nodes. A validator node is responsible for verifying and maintaining a record of transactions.

Sharding makes transactions very fast at around 3,000 transactions per second, compared to Bitcoin, which does around 4.5 transactions per second.

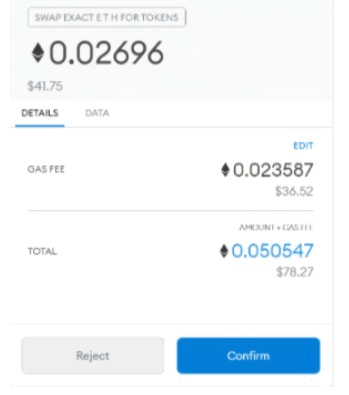

More goods are the gas fees are VERY low at around 1 cent. Ethereum can have VERY high gas fees.

More good news is that if you stake NEAR, there is only a 2-day hold if you decide to unstake it. Some projects are more strict, such as Polkodot, which makes you wait 3-4 weeks.

In a nutshell NEAR Protocol does have a solid foundation!

NEAR also works well with others, which is important. It’s like the guy at a job who has a good attitude and gets along with everyone; he has value, compared to the guy who is constantly complaining, right?

NEAR works with other blockchains, with Aurora allowing developers to bring over their dApps on Ethereum and run them on Near Protocol with fewer fees.

Aurora is an EVM (Ethereum Virtual Machine), and it’s the same code that runs Ethereum and its smart contracts.

Another way that NEAR plays well with others is the rainbow bridge (nice name, right?). This just lets someone move their money from different blockchains onto NEAR.

The last cool thing I can think of (I’m sure there is more) is that it works well with developers. 30% of the gas fees (too bad they are low) go to the developers.

They also support many Coding languages that developers can use.

NEAR Protocol Roadmap 2026: Leading the AI-Native Blockchain Revolution

The NEAR token does have a lot of good stuff going for it, but there are some concerns.

One concern is that there are not a lot of users using NEAR. Seriously, the name NEAR PROTOCOL just sounds boring, right?

The marketing department is sleeping too much, and the word isn’t out on this project.

Also, the token isn’t available in many exchanges, and this hurts the project. For U.S. holders, the only place is Crypto.com, or I’ve found it on Binance.

The third concern right now is that the NEAR Protocol is centralized (controlled by a few people) with 4 board members. In the future, the plan is to have DAOs and Guilds run the show.

DAOs are Decentralized Autonomous Organizations, where the more tokens you have, the more voting power you have to decide the direction of the project.

They only have 100 validators, and it’s very difficult to become a validator. As of right now, only validators can vote on stuff.

The largest concern is that it faces some LARGE competition from other smart contract projects. There really are SO many, and Ethereum has a HUGE advantage being first with name recognition.

I also believe “speed” is very important when it comes to business.

Oh, and the fifth concern is that the tokenomics aren’t the best, and this could hurt the price of the token.

NEAR Tokenomics 2026: The Inflation Halving and Burn Mechanism Explained

The NEAR Protocol isn’t deflationary due to the 5% inflation per year. The project does burn transaction fees, and if a smart contract is involved, 30% of the fees go to the creator.

Deflationary means the supply drops, so each coin is worth more. This is the opposite of inflation, when a country prints TONS of money, and your money gets worth even less.

For example, Bitcoin supply is dropping, and this means it’s deflationary. Low supply and high demand mean a price increase. Of course, there still HAS to be demand, right?

Some people are fascinated with the technology of the blockchain, but they ALL have some type of coin attached to it, and this helps with funding, getting attention, and motivating people to use it.

The NEAR protocol has the NEAR coin (could have guessed this right?), and there is a maximum supply of 1 billion NEAR tokens, with around 600 million currently in circulation.

The coin is used to…

- Pay for transaction fees.

- Governance (vote on stuff).

- On-chain data storage

- Rewarding validators and stakers.

- Helps pay developers to develop on the blockchain.

Many early investors have them locked. This means they can only sell their coins after a certain amount of time.

This means to be careful of these dates because early investors might want to sell their coins, and this could drive the price down.

The good news is staking (where coins are locked), I wrote how staking works HERE, and fee burn can help, but the supply is still increasing, as you can see from the chart below.

Final Verdict: Is NEAR Protocol Still a Top Layer-1 Buy in 2026?

The NEAR Protocol has a solid foundation, but has poor marketing, and the tokenomics aren’t good for investment reasons.

If you’re interested in earning good money with your crypto, I would recommend checking this out HERE.

Another way to make some extra cash is with affiliate marketing. What is so great about it is you can do it anywhere, anytime, around your schedule, with very low startup cost, in nearly any niche, and it can be a TON of fun.

I’m giving away a FREE guide on the system I’m using HERE.

I hope this blog post might have been a little helpful. Bye for now.