This post was originally published in [2022] and has been fully updated for 2026 with new data and tools.

Most “best of” reviews ignore the technical plumbing of where your money actually goes.

To answer the question Wealthfront $8 million FDIC insurance is it legit? It’s worth noting is the distinction between SIPC and FDIC coverage.

While your funds are moving between Wealthfront and its 32 partners, you are relying on brokerage insurance, not bank insurance.

Wealthfront uses multiple partner banks, and all these banks are FDIC-insured. FDIC Insures up to $250,000 per person, per bank.

Keep reading, and I’ll share what Wealthfront is, how FDIC Insurance works, how to get started with Wealthfront, how fintech compares to DEFI, and a red flag when it comes to bonds.

Total FDIC Coverage Auditor

Check if you’re exceeding the $250k limit across partner banks.

(e.g., your personal Citi or Wells Fargo account)

SAFE

Your total combined balance is within the $250,000 FDIC limit.

What is with the SIPC and FDIC coverage at Wealthfront?

In 2026, the SIPC insurance limit is $500,000 per customer, with a maximum of $250,000 for cash claims. Your money is protected by this when it moves from Wealthfront and its 32 partners.

Also, while your money sits at Wealthfront, it’s protected by SIPC and up to $250,0000 for cash claims.

While your money is sitting at its partner banks, it’s under the FDIC insurance, which protects it up to 8 million dollars.

32 banks at $250,000 is 8 million dollars.

Wealthfront isn’t a bank, and that is why it has less money than the FDIC.

Is Wealthfront a Bank? Understanding the 2026 Fintech Brokerage Model

Wealthfront is a Fintech or Robo-advisor for banking services. A robo-advisor uses a computer algorithm to help you pick investments, similar to how Google finds content for the internet.

You could say it’s similar to artificial intelligence.

It starts with questions about your goals and then matches you with investments. Once your account is funded, the robo-advisor can also buy and sell investments based on your goals.

A Fintech company such as Wealthfront doesn’t have a physical location, but instead is Thin or Fin and just uses a website and some employees.

This company got started in 2008 in Palo Alto, California, and its goal is to manage ALL your money. They call it self-driving money, just like a self-driving car.

How it would work is you would connect your bank to Wealthfront, and as soon as you get paid, Wealthfront would pay your bills and invest for you.

For this convenience, you would pay a fee, and that is 0.25%. There are also some fees for ETF Exchange Traded Funds. The person who wrote the book A Random Walk Down Wall Street is the CEO of Wealthfront.

Another benefit of Wealthfront is that it may save someone money on their taxes.

FDIC Insurance Limits for 2026: How Sweep Networks Maximize Your Safety

FDIC Insurance is an agency of the United States government that protects consumers in case they deposit money at a bank, and the bank fails.

When you deposit money into a bank, they use that money and loan it to others. Banks get paid with your money. When banks loan money, they charge interest. You can earn a “tiny” amount of interest with a savings account at a bank.

What would happen if everyone rushed to a bank to withdraw their money?

The bank would fail, and this happened from 1929 to 1933 during the start of the great depression in the United States.

What happened is MANY people were scared and rushed to remove their money. This caused MANY banks to fail, leading Franklin D. Roosevelt, the president, to create something known as FDIC Insurance.

FDIC Insurance really just gave people confidence that their money would be safe at the bank.

Even if the bank failed, their money would be safe, and there would be NO reason to have a run at the bank (this is when everyone rushes to withdraw their money).

Wealthfront Minimum Deposit 2026: Starting a Cash Account vs. Automated Investing

The minimum amount needed to open an account with Wealthfront is $500. Other requirements are that the individual is 18 years of age or older, has a U.S. social security number, has a U.S. residential address, and has a U.S. phone number.

If you want to open an account, the first step is to choose an account type, such as individual, joint (when 2 people use the same account), or trust. They also have 4 different types of IRA accounts.

- Traditional IRA

- ROTH IRA

- SEP IRA

- 401k Rollover.

Step 2 is to answer some questions. These questions include things like…

- What’s your main investing goal?

- Who will own the account?

- What’s your name and email address?

- What is your pre-tax income?

- What’s your liquid net worth?

- What would you do if your portfolio lost 10% of its value in a month?

- What are you most focused on when investing?

Step 3 is to view your investment plan page. This also has a risk slider where you can view your risk tolerance. 0.5% means you want SUPER safe investments, and 10 is VERY risky.

If you go to the low scale, then your money will be in Bonds.

At the time of this blog post, there is some nasty inflation, and this means the government will probably raise interest rates, which is NOT good for bonds.

Bonds mean you loan money for interest. Interest rates and bond prices generally move in opposite directions, so when market interest rates rise, prices of fixed-rate bonds fall.

Oh, and if you’re at a 10, then most of your money will be in stocks.

Step 4 is to fund your account, and you need at least $500 to start.

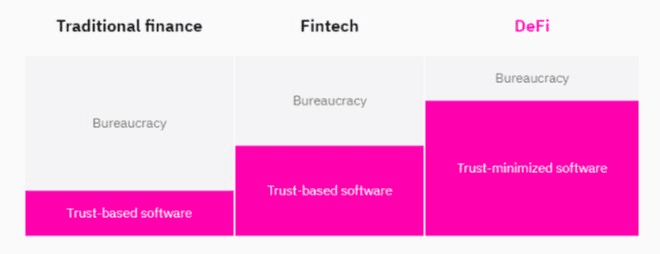

Rewrite: Wealthfront vs. DeFi: Comparing 5% APY Safety to Decentralized Finance Risks

Wealthfront is a Fintech company that has around 238 employees, and DEFI is a banking company that has 0 employees, where everything is run on a blockchain.

The advantage of DEFI over a fintech company is that there are fewer fees because there is “even” less overhead. The bad news with DEFI is that there may be less customer service because it’s just based on code and a helpful community.

DEFI stands for decentralized finance, and it has to do with crypto.

How DEFI works is that all the transactions are on a blockchain. This means it’s an open ledger and everyone can see ALL the transactions.

Fintech is a company that doesn’t have a physical location, but still has employees and some overhead.

Conclusion to Wealthfront $8 million FDIC insurance: Is it legit?

The banking industry is going through some changes. With the creation of Wealthfront, robo-advisors, and DEFI, things are going to get exciting.

I actually wrote a blog post about Fintech that you can read HERE with 12 ideas that are exciting and where the future is headed.

In the end, “I’m scared shitless” of handing my money over to a robo-advisor or even a financial planner.

With Crypto, I had to start very small to gain confidence, and I still don’t fully trust it, but I have to keep ahead of inflation!

In the long run, I’m “very” bullish on DEFI. Many things a bank can do could be done on a blockchain with less overhead.

Overhead does matter, just look at Blockbuster vs. Netflix. Yeah, we all know how that ended.

In fact, in my OWN life, overhead matters and I’m a cheap ass. Yeah, I’m re-reading The Millionaire Next Door, which is a great book.

When it comes to DEFI there are many projects, but the one I’m MOST excited about is this one right HERE.

We live in some crazy times, and it’s not a good idea to just count on 1 income source, like the government or a job, because things change.

One way to diversify is with a side hustle.

Affiliate marketing is not a bad idea because you can do it anywhere, anytime, around your schedule, with very little start-up cost, in nearly any niche, and it can be a lot of fun.

I’ve been doing it for 15 years, and I’m giving away my system for FREE HERE.

I hope this blog post on is Wealthfront FDIC insured was helpful to you. Bye for now.